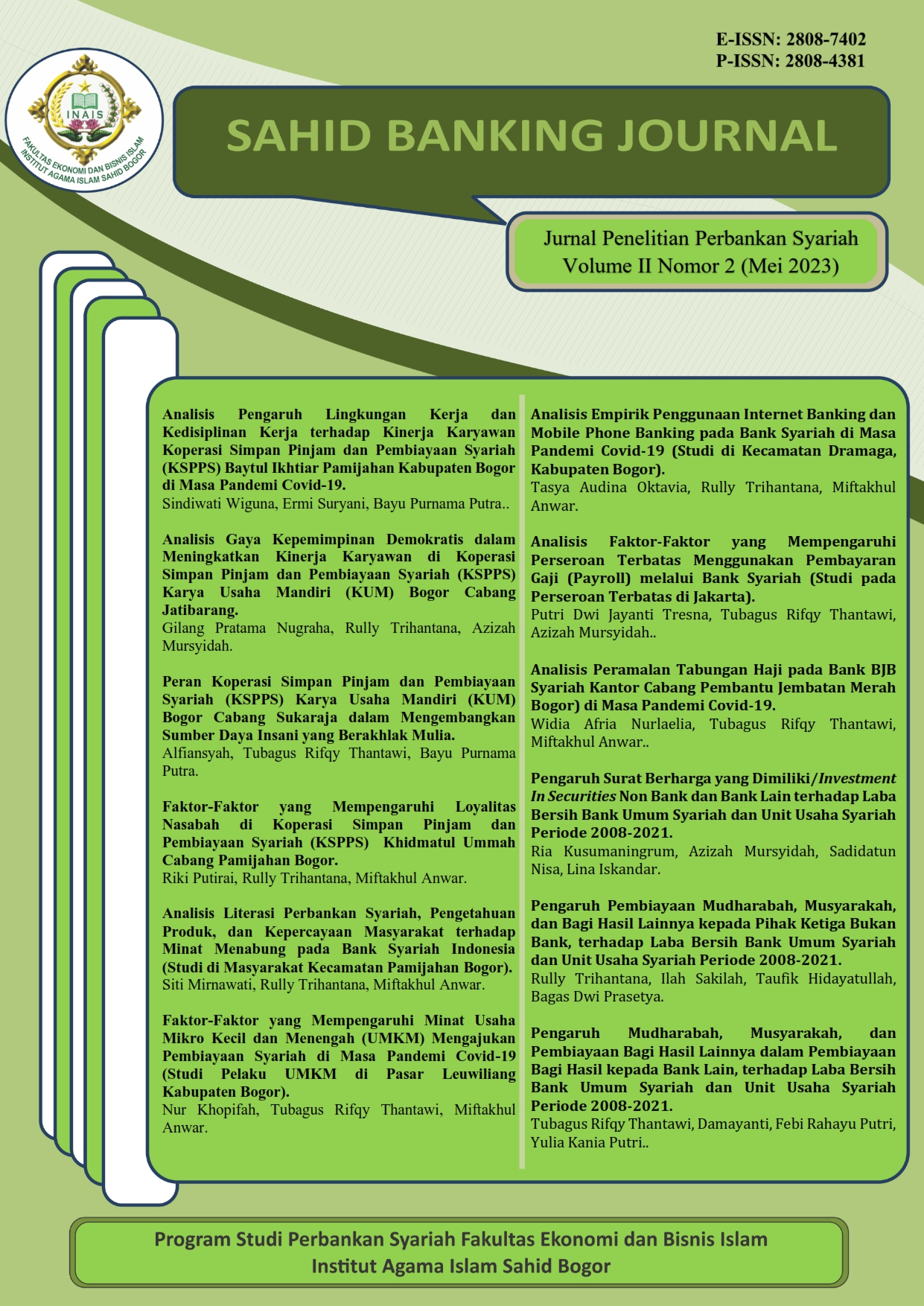

FACTORS AFFECTING INTEREST SMALL AND MEDIUM MICRO ENTERPRISES (MSMEs) APPLYING FOR SHARIA FINANCING IN THE TIME OF THE COVID-19 PANDEMIC (STUDY OF UMKM ACTORS IN THE LEUWILIANG MARKET BOGOR DISTRICT)

DOI:

https://doi.org/10.56406/sahidbankingjournal.v2i02.108Keywords:

Micro, Small and Medium Enterprises, Financial Literacy, Guarantee, Length of Business, Services, Credit Procedures, and InterestAbstract

The micro, small and medium enterprises sector is one of the sectors that has fallen due to the Covid-19 pandemic. This outbreak almost paralyzed the wheels of the domestic economy, one of which was micro, small and medium enterprises experiencing capital difficulties during the Covid-19 pandemic due to declining income. This study aims to find out what factors can influence the interest of micro, small and medium enterprises to apply for financing during the Covid-19 period, especially the Leuwiliang Market area, Bogor Regency. Researchers use the Multiple Linear Regression Analysis type of research. Data collection is carried out through the distribution of questionnaires. The results of this study obtained factors that do not have an influence on the interest of micro, small and medium enterprises to apply for financing during the Covid-19 period in the Leuwiliang Market, Bogor Regency are financial literacy variables and business duration variables. Finally, collateral variables, services, and credit procedures have an influence on micro, small and medium enterprises interest in applying for financing during Covid 19.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Nur Khopifah; Tubagus Rifqy Thantawi; Miftakhul Anwar

This work is licensed under a Creative Commons Attribution 4.0 International License.