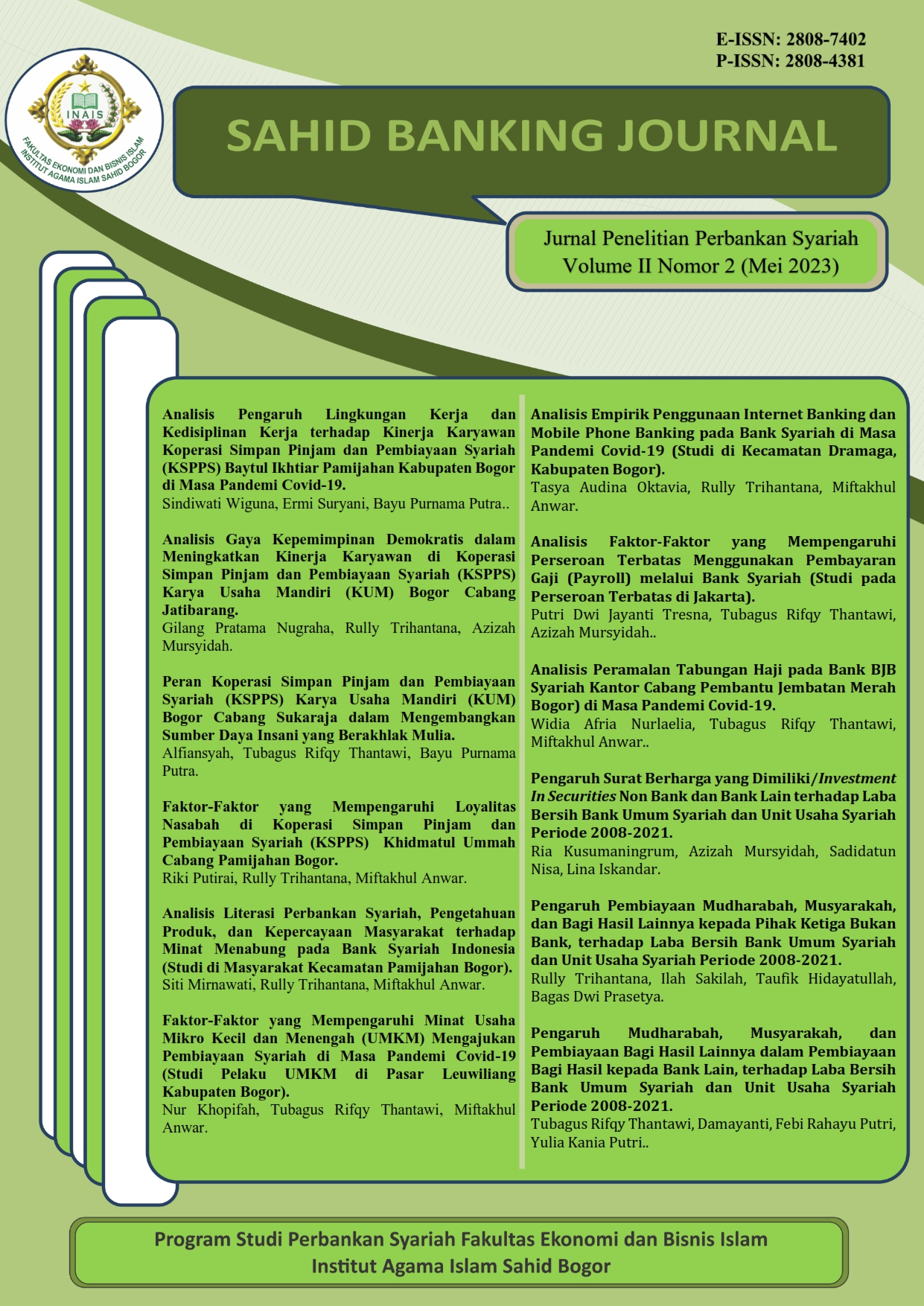

THE EFFECT OF MUDHARABAH, MUSYARAKAH, FINANCING AND SHARE OTHER RESULTS TO NON-BANK THIRD PARTIES, ON THE NET PROFIT OF SHARIA COMMERCIAL BANK AND SHARIA BUSINESS UNITS FOR THE 2008-2021 PERIOD

DOI:

https://doi.org/10.56406/sahidbankingjournal.v2i02.113Keywords:

Mudharabah Financing, Musyarakah, Other Profit Sharing, Net Profit, Non-Bank Third Parties, Sharia Commercial Bank, Sharia Business UnitAbstract

One main distribution pattern carried out by sharia banks is the principle of profit sharing with mudharabah and musyarakah agreements. The profit sharing income obtained by Islamic banks is in accordance with the agreed ratio, the bank's profit depends on the customer's profit. Regarding the influence of mudharabah and musyarakah profit sharing financing on net profits in Sharia Commercial Banks and Sharia Business Units in Indonesia in the 2008-2021 period, the problem question is whether and how profit sharing financing to non-bank third parties/profit sharing financing to non-banks occurs in Mudharabah, musyarakah and other profit-sharing financing have a partial and simultaneous effect on net profit. Based on the research results, it is proven that the hypothesis of profit sharing financing to non-bank third parties/profit sharing financing to non-banks in terms of (except Mudharabah), musyarakah and other profit sharing financing, has a partial effect on net profit. Then it was also proven that profit sharing financing to non-bank third parties/profit sharing financing to non-banks in terms of mudharabah, musyarakah and other profit sharing had a simultaneous effect on net profit.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Rully Trihantana, Ilah Sakilah, Taufik Hidayatullah, Bagas Dwi Prasetya

This work is licensed under a Creative Commons Attribution 4.0 International License.