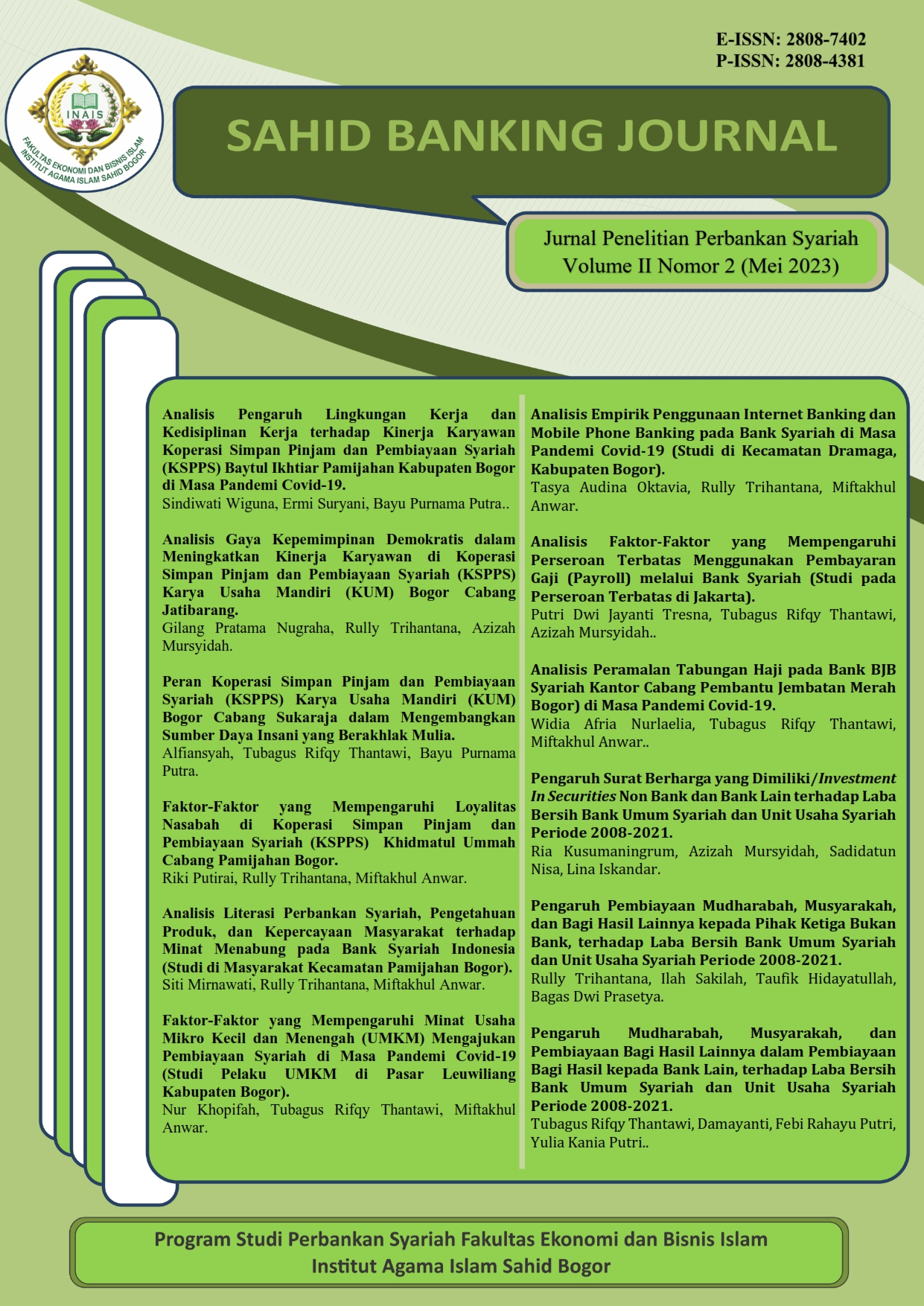

ANALYSIS OF SHARIA BANKING LITERACY, PRODUCT KNOWLEDGE, AND PUBLIC CONFIDENCE IN INTEREST IN SAVING AT INDONESIAN SHARIA BANK (STUDY IN THE PAMIJAHAN BOGOR DISTRICT COMMUNITY)

DOI:

https://doi.org/10.56406/sahidbankingjournal.v2i02.107Keywords:

Islamic Banking Literacy, Product Knowledge, Public Trust, and Saving InterestAbstract

Bank Syariah Indonesia is the largest Islamic banking service in Indonesia. This Indonesian Islamic Bank has a problem, namely there is still a lot of public understanding, especially in Pamijahan Bogor District, which is still deviant and there is no complete trust in Bank Syariah Indonesia. This study aims to determine whether there is a positive value between Islamic Banking Literacy, Product Knowledge, and Public Trust on Interest in Savings at Indonesian Islamic Banks. This type of research is quantitative with data collection methods using primary data obtained through questionnaires. Sampling amounted to 270 respondents. The method used to test the hypothesis is multiple linear regression, t test, f test, and coefficient of determination (R square). The results of this study indicate that Product Knowledge t count 2.784 > t table 1.969 and the resulting sig 0.006 < 0.05 Public Trust t count 9.672 > t table 1.969 and the resulting sig 0.000 < 0.05 So it can be concluded that the variable Product Knowledge, and Public Trust has an effect on Saving Interest in Indonesian Islamic Banks. Meanwhile, Islamic Banking Literacy has no effect on interest in saving at Indonesian Islamic Banks. Simultaneously, the factors of Product Knowledge and Public Trust have a significant and significant effect on Saving Interest in Indonesian Islamic Banks. This is evidenced by the calculated F value of 110.369 > Ftable 2.64 with a sig level of 0.000 or α=5%. While the coefficient of determination R Square is 0.555 or 55,5%, the remaining 44.5% is influenced by other factors.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Siti Mirnawati, Rully Trihantana, Miftakhul Anwar

This work is licensed under a Creative Commons Attribution 4.0 International License.